Target audience: Financial Services Team

There may be times a credit card refund (Refund by Transaction ID) was completed but was not applied to an invoice. A member of the financial services team should resolve this issue.

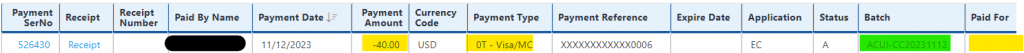

Refunds will display as a negative payment with a payment type of VISA/MC or AMEX and have no data in the Paid For column.

Apply the refund

- Click on the Batch ID (highlighted in green above) which will open the batch window

- Click Unapplied Payments

- Click on the negative dollar amount

- Apply the negative payment to the appropriate invoice. If the invoice is not listed because the Bill To is for another customer, follow the steps below to create an adjustment.

Enter Adjustment to Allow Refund to be Applied to Another Bill To ID

- Paid For: Enter the Bill To ID from the refund and customer ID of the Bill To ID of the invoice to be credited. Be sure the appropriate customers are listed below the field.

- Paid By: Enter Bill To ID from the refund

- Payment Amount: 0

- Payment Type: Adjustment

- Batch/Group#: Select the current month transactions batch

- Check # or Payment Reference: “Adjust for credit card refund”

- Enter the refund amount on the invoice to be credited

- Click “Calculate Total Applied Amount” to verify that the payment remaining is a positive number in the amount about the credit

- Click Submit to Put the Remaining Credit in Accounts Receivable

- Proceed to Apply the Refund as outlined above

Keywords: credit card, wrong account, unapplied, missing credit,